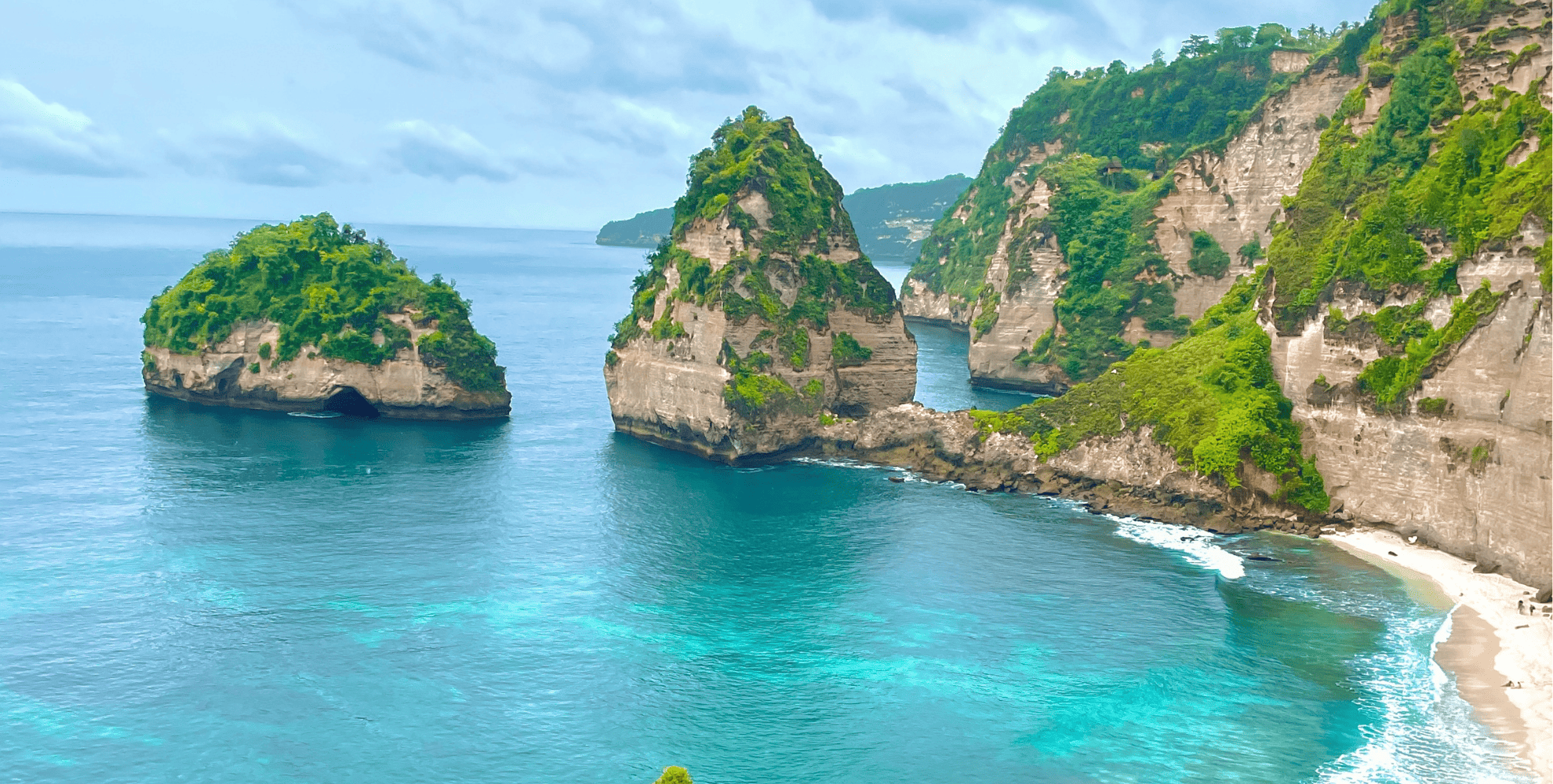

Travelling with children can be a wonderful experience when everything goes to plan, but anyone with children understands that’s not always the case.

Imagine your little one fell ill and desperately needed emergency medical care when you’re in a foreign country. Or what if your child’s suitcase you packed so carefully with everything they’d need while you were travelling was nowhere to be found when you disembarked after a long journey?

When you’ve got the kids in tow and things don’t go to plan, we’ll be there to help get you through it.

Kids covered for free

Every family should be able to enjoy special time spent together holidaying, but expenses can quickly add up when travelling as a family. We want to keep things as affordable for you as possible—that’s why we’ll cover any dependants under your policy at no extra charge .*

Our family travel insurance is designed to keep things simple and straightforward by providing cover for up to two adults (you and your spouse or partner) and your dependants under a single policy.

Provided your children (including step or legally adopted children) are unmarried and either under the age of 19 or under the age of 25 and studying full-time at an accredited institution of higher learning, you can add them to your family policy and we won’t charge you anything extra.*

*An extra premium may be charged for pre-existing medical conditions of your dependants.

Know you’re prepared for a medical emergency overseas

A medical emergency while overseas is never a nice experience for anyone, but when travelling as a family in a foreign or unfamiliar location, it can quickly become a parent’s worst nightmare if you don’t have suitable medical cover.

PassportCard provides valuable reassurance that you’ll be prepared if you, your partner or your children were to become sick or injured while you’re away. Not only will you know you’ll be protected in a medical emergency, but you’ll also have round-the-clock support from our Global Assistance team.

Always just a call or text away, the team is available 24/7 on +61 1800 490 478 or Whatsapp and can help with everything from processing your claim immediately over the phone to directing you to the nearest pharmacy, hospital or doctor.

Instant payouts on approved claims with PassportCard

When taking out PassportCard travel insurance, we also give you the option to be sent a PassportCard. With PassportCard, you can make the claims listed below immediately, anywhere, anytime and once approved we can instantly load money onto the card to help cover your expenses.

Our instant claims:

- If your cash is stolen, we can put up to $500 on the PassportCard that you can withdraw instantly

- Your medical expenses so you’re not out of pocket

- $250 for essentials if your bags are delayed

You won’t need to fill out any paperwork and instant access to funds means you won’t be left out of pocket.

It’s how travel insurance should be – quick, simple and hassle-free.

Find out more about how instant claims work or get a quote for your upcoming trip.

Get cover for your next trip with PassportCard

Family travel insurance FAQs

Yes. Provided they meet the criteria specified in the PDS for dependants and you list them as travellers when you purchase your policy, they will be covered under your policy.

The only cases that you will have to pay for your children is if they have pre-existing medical issues. Apart from those cases, provided your children (including step or legally adopted children) are unmarried and either under the age of 19 or under the age of 25 and studying full-time at an accredited institution of higher learning, you can add them to your family policy and we won’t charge you anything extra.

There is no limit to how many children you can include on your policy provided they are considered a dependant as specified in the relevant PDS.

Yes. We consider the age of each traveller at the time a policy is purchased rather than the age they will be (or will turn) at the time of travel.

Our family policies include cover for up to two adults (you and your spouse or partner) and their dependants. Any additional travellers will need to purchase their own policy.

Yes. If you are planning on including any adventure activities (for example, mountain biking, quad bike riding, outdoor rock climbing or a Segway tour) on your trip, it’s important that you add the Adventure Activities Cover option when purchasing your travel insurance policy.

While you should have the same level of access to medical care as you would normally, travel insurance can still be very valuable when travelling as a family to ensure you’re prepared for things like your trip being cancelled or cut short, or if your luggage or belongings are lost, stolen or damaged.

It’s important that you let us know if you are 26 or more weeks pregnant, have had any complications with your current or a previous pregnancy, are experiencing a multiple pregnancy or have a medically assisted pregnancy, or you won’t be covered for any serious or unexpected pregnancy-related complications. Please refer to the relevant PDS for more information about travelling while pregnant.

Simply call our Global Assistance team on +61 1800 490 478. Our Australian-based Global Assistance team is available 24/7 and can quickly handle most common claims on-the-spot over the phone.

Tips when travelling as a family

With so much to think about when planning a family getaway, it’s easy for some things to slip your mind. To help your family holiday go off without a hitch, here are some helpful tips to make sure you’ve ticked everything off your list:

- Check everyone’s passport is valid with at least 6 months of validity left before the expiry date

- Do your research to choose family-friendly destinations and pre-arrange your accommodation in each location you plan to stay in

- If travelling with young children, try not to include too many destinations on your itinerary, as the constant packing and unpacking can become stressful

- Ensure each of you meets the visitor entry requirements for the countries you are visiting

- Arrange a travel currency card or other method of payment to cover expenses while you’re away

- Notify your financial institution of your plans to travel

- Contact your phone provider to ensure your phone plan will cover you while you’re away or purchase a pre-paid international SIM card

- Speak to your family or travel doctor to see if any of you will need any vaccinations prior to travelling

- If any family members take medications, ensure you take a large enough supply with you to last the entirety of the trip, as well as some extra to cover you in case of any significant delays

- If you’ll be doing any long-haul flights with an infant, see if you can pre-book a bassinet through your airline

- If your flights include meals, contact your airline to see if you can request kids meals for your children and remember to notify them of any allergies

- Remember to pack any medications, wipes, nappies and toiletries your children might need into your carry-on luggage, along with a change of clothing so you’re prepared for any accidents or spills

- Consider loading up on snacks and entertainment to help keep little ones occupied while in transit

- When booking your accommodation, consider whether you’ll be happy to eat out most of the time or if you’ll need accommodation with cooking facilities

- Consider pre-booking any tours or activities you want to do, as some travel providers and tour operators offer family discounts

- Provide details of your travel plans to a family member or close friend not travelling with you so you can be contacted in case of an emergency

- Visit the Australian government’s Smartraveller website for the latest travel advice for the destination/s you are travelling to

- Save the details of how to access emergency consular assistance in case you need it

- Organise your travel insurance with PassportCard.

When choosing travel insurance, it’s important to carefully read the relevant PDS prior to purchase to understand whether the product suits your specific needs.

All benefits and covers are subject to the terms, conditions, limitations and exclusions listed in the Combined Financial Services Guide and Product Disclosure Statement (PDS) and on other policy documentation, including the schedule.

*Sub limits apply, ^per insured Adult, × per policy, # Waiting periods, ~ Limited to 12-month period, + per day, ¹PassportCard Travel Insurance recognised in Mozo Experts Choice Awards 2025 – more information on the awards research methodology at Mozo. The Canstar 2025 Innovation Excellence Award was received in April, 2025 for PassportCard Travel Insurance.

All benefits and covers are subject to the terms, conditions, limitations and exclusions listed in the Combined Financial Services Guide and Product Disclosure Statement and on other policy documentation, including the schedule.